12 Common FAFSA Mistakes

Beginning this year, you’ll also be required to use earlier (2015) tax information than in previous years. How does that benefit you? Since you’ve already filed your 2015 taxes, you’ll be able to transfer your tax information into your FAFSA right away! (And you won’t need to update your FAFSA after you file 2016 taxes.)

These exciting changes are sure to save you time and make the FAFSA much easier to complete. Just make sure to take your time so you don’t make one of these mistakes:

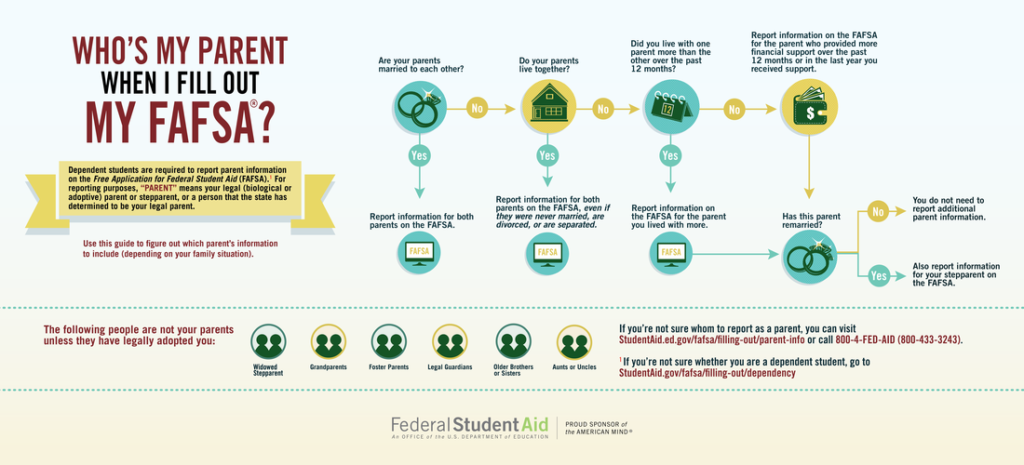

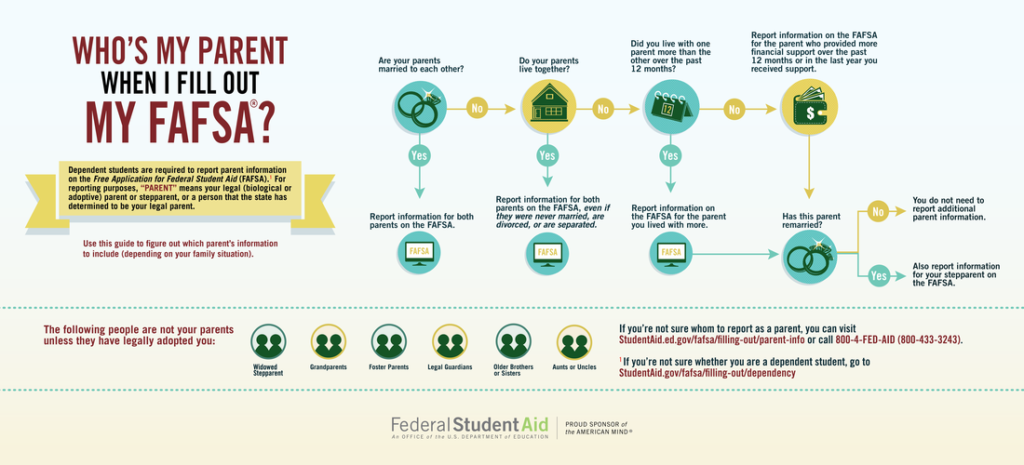

1. Not Completing the FAFSAI hear all kinds of reasons: “The FAFSA is too hard,†“It takes too long to complete,†I never qualify anyway, so why does it matter?†It does matter. The FAFSA is not just the application for federal grants such as the Pell Grant. It’s also the application for work-study funds, low-interest federal student loans, and even scholarships and grants offered by your state, school, or private organization. If you don’t complete the FAFSA, you could lose out on thousands of dollars to help you pay for college. ..”

Continue reading the 12 Common FAFSA Mistakes, click here.

FAFSA has changed deadlines and requirements for this year. Call me today to learn how FAFSA can help you as you apply to college. I offer a complimentary college and scholarship consultation to get you started.

P:713.447.0064

E: Nadine@cash4college.net